The late-game team fight is about to erupt. Every cooldown, every point of mana, and every single piece of gold spent on your inventory has led to this moment. A misclick, a wasted ultimate, or a poorly timed purchase from minutes ago can be the sole reason for a victory or a crushing “GG.” As a strategic gamer, you live and breathe this level of optimization. You understand resource allocation, risk assessment, and long-term planning on a level most people never experience.

Now, what if I told you that managing your personal finances is the most complex, rewarding real-time strategy (RTS) game you’ll ever play? The stakes are higher than any ladder ranking, and the prize is your ultimate win condition: financial freedom.

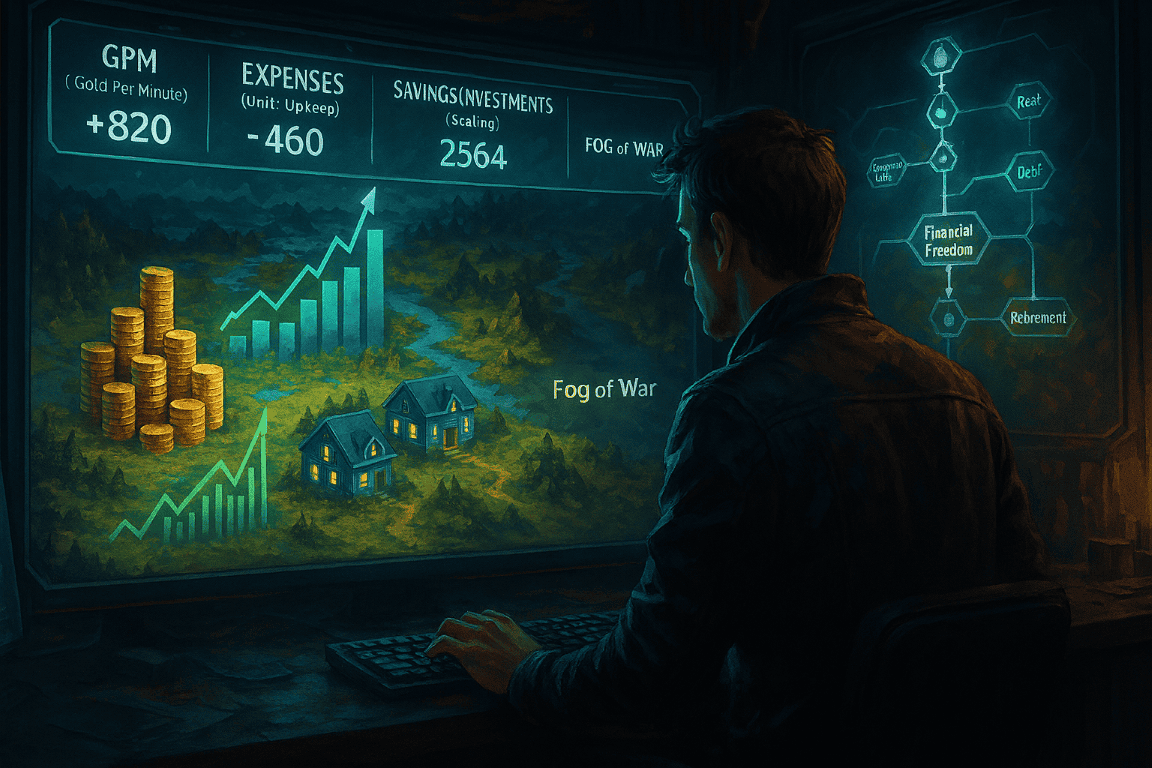

Your income is your Gold Per Minute (GPM). Your expenses are your unit upkeep and item costs. Your savings and investments are your scaling stats, preparing you for the late game. Too many people play this game on autopilot, blindly following the minimap and wondering why they keep getting ganked by unexpected bills and financial emergencies.

This guide is your VOD review, your pro-level strategy session. We will break down the complex world of personal finance into the core mechanics you already understand. Forget confusing jargon and boring advice. It’s time to apply your elite gaming mindset to the one game that truly matters. Prepare to optimize your build, master your macro, and secure your financial throne.

Mastering Your Financial “Fog of War”: The Power of Scouting and Vision

In any strategy game, playing without vision is a death sentence. You can’t counter an enemy push if you don’t see it coming. You can’t secure an objective if you don’t know if the area is clear. The “Fog of War” in your financial life is the ambiguity of where your money is actually going. To win, you must first achieve total map awareness. This is budgeting, but let’s call it what it is: active intelligence gathering.

Your first mission is to deploy observer wards across your entire financial map. This means tracking every single dollar that comes in and goes out for at least one month. No exceptions.

Actionable Strategy: The 30-Day Scouting Mission

- Choose Your Tool: You can use a dedicated budgeting app, a simple spreadsheet, or even a notebook. The tool doesn’t matter as much as the consistency. Think of this as choosing your preferred hotkey setup; pick what feels most efficient for you.

- Log Every Transaction: That $5 coffee? Log it. The $12.99 monthly subscription you forgot about? Log it. Your paycheck? Log it. This is your combat log. It provides raw, unfiltered data about your financial gameplay.

- Be Brutally Honest: Don’t fudge the numbers or skip logging an embarrassing impulse purchase. A pro player reviews their mistakes to learn from them. Hiding a bad play from yourself guarantees you’ll repeat it.

At the end of the 30 days, you’ll have a complete replay of your financial performance. Now, it’s time for VOD review.

Actionable Strategy: Post-Game Analysis

Categorize every single expense. Don’t just list them; understand their function. A simple, powerful framework is to sort them into three buckets:

- Core Build (Needs): These are the essential items for survival. Rent/mortgage, utilities, essential groceries, insurance, transportation to work. Without these, your game is over before it begins.

- Situational Items (Wants): Dining out, entertainment, streaming services, new gadgets, hobbies. These can enhance your game and provide buffs (like morale), but they aren’t essential to survival. This is where most players overspend.

- Scaling & Upgrades (Savings & Investments): This is money you put towards paying down debt, building your emergency fund, and investing for the future. This is you putting experience points into your late-game stats.

Once you have this map, the Fog of War vanishes. You might be shocked to see a $200/month “gank squad” of miscellaneous subscriptions slowly draining your resources. You might discover your “Dining Out” budget has a higher GPM drain than your “Groceries” budget. This isn’t a moment for judgment; it’s a moment of strategic clarity. You now have the intel required to make informed decisions.

Defining Your Win Condition: Setting Financial Goals Like Game Objectives

You wouldn’t start a match of StarCraft or Civilization without a victory condition in mind. Are you going for a timing push, a technology victory, or economic dominance? Vague goals like “get rich” are as useless as “win the game.” You need specific, measurable objectives to guide your strategy.

In finance, these are your Win Conditions. They must be tangible and actionable. The best framework for this is the SMART system, which you can think of as your strategic overlay.

- Specific: What exactly do you want to achieve? Don’t say “save for a car.” Say “save for a $5,000 down payment on a reliable used Honda Civic.”

- Measurable: How will you track your progress? “$5,000” is measurable. “A lot of money” is not.

- Achievable: Is this objective realistic given your current GPM (income) and upkeep (expenses)? Aiming for a $1 million net worth in one year on a $50,000 salary is a fantasy build.

- Relevant: Does this objective align with your overall life strategy? Does buying that new car help you achieve your ultimate goal of financial independence, or does it delay it?

- Time-bound: When will you achieve this? “I will save $5,000 for a down payment in 12 months by setting aside $417 per month.”

Example: From Vague Wish to Actionable Quest

- Vague Wish: “I want to be better with money.”

- SMART Win Condition: “I will build a ‘Tier 1 Emergency Fund’ of $2,000 (Specific, Measurable) within the next 5 months (Time-bound) by auto-transferring $400 from my paycheck on the 1st of every month (Achievable). This will act as my ‘Guardian Angel’ passive, protecting me from unexpected financial ganks like a car repair or medical bill (Relevant).”

Define your short-game (1 year), mid-game (1-5 years), and late-game (5+ years) objectives.

- Short-Game Objectives (Early-Game Farming): Build a full emergency fund, pay off high-interest credit card debt.

- Mid-Game Objectives (Securing the Mid-Game): Save for a house down payment, pay off student loans, invest consistently.

- Late-Game Objectives (The Endgame): Financial independence, comfortable retirement, leaving a legacy.

With clear Win Conditions, every financial decision now has a purpose. Does this purchase help me achieve my objective, or does it distract me?

The Early Game: Crafting Your Financial “Build Order”

In any RTS, the first few minutes of the game are critical. Your “build order”—the precise sequence of actions you take—sets the foundation for your entire match. A flawed build order can put you so far behind that recovery is impossible. Personal finance is no different. You must execute a proven, optimal financial build order to establish a strong economic base.

Step 1: Build a Pylon (The Starter Emergency Fund)

As advised by Investopedia, before you do anything else—before you aggressively pay down debt, before you invest—you must secure a small cushion. This is your first Pylon or Supply Depot. It powers everything else and prevents you from being supply-blocked when a small crisis hits.

- Action: Save $1,000 as quickly as humanly possible. Put it in a separate high-yield savings account that you don’t touch. This isn’t an investment; it’s your respawn buffer. When your tire blows out, you use this fund instead of a credit card, preventing you from falling behind.

Step 2: Target the Highest DPS Threat (High-Interest Debt)

Average U.S. credit card interest rate ~21% (all accounts) according to the Federal Reserve.

High-interest debt, especially credit card debt, is the enemy’s glass cannon hero that is farming your economy while you’re not looking. An 18%+ APR is a constant, crippling damage-over-time effect on your net worth. You must focus fire and eliminate this threat immediately.

Two popular strategies exist for this, the “Avalanche” and “Snowball” methods.

- The Avalanche Method (The Min-Max Strategy): This is the mathematically optimal play. You list all your debts by interest rate, from highest to lowest. You make minimum payments on everything except the debt with the highest interest rate. You throw every spare dollar at that one until it’s gone. Then, you move to the next highest. This saves you the most money in interest over time.

- The Snowball Method (The Morale-Boost Strategy): This is psychologically powerful. You list your debts by balance, from smallest to lowest, regardless of interest rate. You focus all your extra cash on the smallest balance. When you pay it off, you get a quick win and a motivational boost. You then take the money you were paying on that debt and roll it into the next smallest one.

Which is better? The one you’ll stick with. For a pure strategist, the Avalanche method is superior. But if you need those small victories to stay in the fight, the Snowball is an incredibly effective tool.

Step 3: Fortify Your Base (The Full Emergency Fund)

Once the high-interest debt threat is neutralized, it’s time to build your fortress. You need an emergency fund that covers 3 to 6 months of your essential living expenses (your “Core Build” costs).

- Calculation: Look at your budget. Add up your monthly rent/mortgage, utilities, food, insurance, and transportation. Multiply that number by 3-6. That is your target.

- Example: Your essential expenses are $2,000/month. A 3-month fund is $6,000. A 6-month fund is $12,000.

- Storage: Keep this in a secure, liquid account like a high-yield savings account. This is your treasury. It’s not for attacking or investing. It’s the “GG” prevention fund for if you lose your primary source of income.

Executing this build order—Starter Fund -> High-Interest Debt -> Full Emergency Fund—is the single most powerful sequence to guarantee a stable mid-game.

Optimizing Your Gold Per Minute (GPM): Maximizing Income and Cash Flow

In MOBAs, GPM is the lifeblood of a carry. The more gold you generate, the faster you get your items, and the sooner you can take over the map. Your personal GPM is your monthly cash flow—the money left over after all your expenses are paid. Increasing this number is the primary way you accelerate your path to your Win Condition.

1. Improve Your Last-Hitting (Optimize Your Primary Income)

Your main job is your most consistent source of “creep” farm. Getting better at it yields the highest returns.

- Actionable Strategy: Skill Ups and Raises. Don’t just passively do your job. Identify the skills that lead to promotions and higher pay in your field. Are there certifications you can earn? New software you can master? Treating your career like a skill tree you are actively leveling up is the surest path to higher income. When you have a portfolio of accomplishments and new skills, you have the leverage to negotiate a raise or find a higher-paying position elsewhere.

2. Farm the Jungle (Develop Additional Income Streams)

The map is full of neutral “jungle camps” of income. These are your side hustles. This isn’t about working yourself to burnout; it’s about strategically converting your free time and skills into extra gold.

- Actionable Strategy: Monetize Your Skills. Are you a high-ranked FPS player? Offer coaching. Are you great at graphic design for your guild website? Offer freelance services. Do you have a knack for writing or editing? Take on small projects. Even simple things like food delivery or pet sitting during peak hours can add a few hundred dollars to your GPM, which can be used to supercharge your debt payoff or investment strategy.

3. Deny Enemy Creeps (Strategic Expense Reduction)

Here’s a concept every Dota player understands: it’s often more valuable to deny an enemy creep (preventing them from getting gold) than it is to get a last-hit yourself. Cutting an expense is a guaranteed, tax-free return on your money.

- Actionable Strategy: The Subscription Audit. Go through your bank statement and hunt down every recurring charge. Netflix, Spotify, Amazon Prime, Xbox Game Pass, niche streaming services, mobile apps. For each one, ask: “Do I get enough value from this to justify the cost?” Every canceled subscription is a permanent boost to your GPM.

- Actionable Strategy: The Bill Negotiation Push. Many bills, like cable, internet, and cell phone services, are negotiable. Set aside an afternoon. Call your providers. Tell them you are considering switching to a competitor who is offering a better rate. Be polite but firm. You will be astonished at the “retention” deals they can offer. A 15-minute phone call that saves you $30/month is an incredible ROI on your time.

The Armory: Understanding Your Financial “Item Builds”

Once your GPM is optimized and your early game is stable, it’s time to start buying items. In finance, your “items” are assets—things that have the potential to grow in value or generate income. This is investing. Walking into the armory can be intimidating, with a wall of complex options. But just like in a game, you only need to understand the core items to build an effective loadout.

The Core Items for 99% of Players:

- Index Funds / ETFs (The Recommended Build): For most players, this is the best item in the game. An index fund is a single purchase that buys you a tiny slice of an entire market (like the S&P 500, which is the 500 largest US companies). It’s like buying a pre-packaged, perfectly balanced “recommended item” set. It’s diversified, low-cost, and has historically provided strong returns. You aren’t betting on a single hero (company); you’re betting on the entire team to win over time.

- Individual Stocks (The Niche Counter-Pick): Buying a share of an individual company (like Apple or NVIDIA) is like betting everything on a single, high-skill-cap hero. If you’ve done immense research, understand the meta (the market), and believe in the pick, the rewards can be massive. However, the risk is equally massive. A single balance patch (a bad earnings report) can obliterate your investment. This is an advanced strategy and should only make up a small portion of your portfolio, if any.

- Bonds (The Defensive Item): Bonds are essentially loans you give to a government or corporation. In return, they pay you interest. They are the “Plate Mail” or “Vitality Booster” of the financial world. They generally offer lower returns than stocks but are far less volatile. As you get closer to your Win Condition (like retirement), you sell some of your high-damage stock items and buy more defensive bond items to protect your lead.

- Retirement Accounts – 401(k) & IRA (The Ultimate Ability): These aren’t investments themselves, but special “inventory slots” that give your investments powerful buffs. These accounts provide massive tax advantages. A 401(k) is often offered by an employer, and many will even “match” your contributions up to a certain percentage. This is free gold! It’s a 100% instant return on your investment. If your employer offers a match, contributing enough to get the full match is your highest priority after eliminating high-interest debt. An IRA (Individual Retirement Arrangement) is an account you open on your own, offering similar tax-powered buffs.

Your goal is not to time the market (predict short-term price swings), but to build a strong, diversified loadout and hold it for the long term.

Mid-Game Power Spikes: Strategic Debt and Leverage

Most gamers think of debt as a debuff, and for high-interest debt, that’s true. But some forms of debt can be used strategically as a “power spike,” allowing you to secure a major objective you couldn’t otherwise afford. This is the difference between “bad debt” and “good debt.”

- Bad Debt: This is debt taken on for consumable items or depreciating assets. This includes credit card debt for dinners and vacations, or high-interest personal loans for a fancy TV. The item’s value is gone long before the debt is, leaving you with a permanent GPM drain.

- Good Debt: This is debt used to acquire an asset that will likely appreciate in value or increase your income potential.

- A Mortgage: This is like a team decision to take a loan to secure a Barracks. It’s a huge commitment, but you are acquiring a major strategic asset (a house) that will likely grow in value over the long term and provides utility (a place to live).

- Student Loans (for high-ROI careers): Taking on student loans to become a doctor or software engineer is a calculated investment in your own character build. You are accepting a temporary debuff (the loan) to permanently increase your base GPM stat. The key is ensuring the career path has a high return on investment (ROI).

- A Small Business Loan: This is borrowing to build your own gold mine. It’s risky, but the potential payoff is a massive, independent income stream.

Using debt strategically requires careful calculation. You must be sure that the asset you’re acquiring will provide more value in the long run than the cost of the interest you’re paying.

The Late Game Strategy: Scaling, Compounding, and Protecting Your Throne

This is where the magic happens. In the late game, the “carry” hero who spent the early game diligently farming becomes an unstoppable force. This is the power of compounding.

Compounding is the process of your investments earning returns, and then those returns earning their own returns. It’s an exponential growth curve.

A Concrete Example of Scaling:

Imagine you invest $10,000. It earns an average of 8% per year.

- Year 1: You earn $800. Your new total is $10,800.

- Year 2: You earn 8% on $10,800, which is $864. Your new total is $11,664.

- Year 10: Your investment is worth over $21,500.

- Year 30: Your initial $10,000 is worth over $100,000, without you adding another penny.

This is why starting early is the ultimate cheat code. The player who starts investing a small amount in their 20s will almost always end up with a much larger “final build” than the player who invests a much larger amount starting in their 40s. Time is your most powerful stat.

Protecting Your Throne (Preservation of Capital)

As you approach retirement, your strategy shifts from aggressive growth to capital preservation. You’ve won the map; now you just have to defend your base until the timer runs out. This means rebalancing your portfolio.

- Actionable Strategy: The Glide Path. You gradually sell some of your high-risk, high-reward stock funds (your “damage items”) and buy more stable, low-risk bond funds (your “defensive items”). This reduces your vulnerability to market crashes, ensuring that a sudden “enemy push” (a recession) doesn’t wipe out your life’s work right before you need it.

High APM Finance: Active Management and Automation

High Actions Per Minute (APM) in gaming isn’t about frantic, useless clicking. It’s about efficiency and making many small, smart decisions very quickly. In finance, you can achieve a state of “High APM” not by constantly tinkering, but by building a system that runs itself.

Automation is your custom script for financial success.

- Auto-Pay Your Core Bills: Set up automatic payments for your rent, utilities, and other predictable “Core Build” expenses. This prevents you from ever taking damage from late fees.

- Automate Your Savings: This is the single most important automation. Set up an automatic transfer from your checking account to your savings and investment accounts the day after you get paid. This is “paying yourself first.” You treat your savings goal like a non-negotiable tax. The money is gone before you even have a chance to spend it on impulse buys.

- Auto-Invest Your Funds: Most brokerage platforms allow you to set up automatic investments into your chosen index funds every month. This is called Dollar-Cost Averaging. By investing the same amount of money regularly, you automatically buy more shares when the price is low and fewer shares when the price is high. It takes emotion out of the equation and ensures you are consistently building your position.

By setting up these automations, you’ve essentially programmed your economy to run on a perfect script, freeing up your mental energy to focus on bigger strategic decisions, like career growth and optimizing your Win Conditions.

Reviewing the Replay: The Art of the Monthly Financial VOD Review

The final piece of the puzzle is the feedback loop. Pro teams don’t just play matches; they spend hours reviewing replays, analyzing what went right and what went wrong. You must do the same with your finances.

Set a recurring calendar event for one hour each month: your Financial VOD Review. During this time, you sit down with your budget, your account statements, and your goals.

Ask these critical questions:

- Where did my resources go? Briefly review your spending categories. Were there any surprises? Did any category have significant “creep” (unintentional spending increases)?

- Did I hit my GPM target? How much was left over after all expenses? Did I meet my savings/investment goal for the month?

- Were there any unexpected “ganks”? Did an unexpected expense force me to deviate from the plan? If so, was my emergency fund sufficient? How can I better prepare for it in the future?

- How is my progress towards my Win Conditions? Look at your goal chart. Are you on track? Ahead? Behind?

- What is the strategy for the next “match” (the next month)? Based on this review, are there any adjustments to make? Do I need to allocate more resources to a specific debt? Cut back on a certain “want” category?

This monthly ritual keeps you engaged with your strategy. It prevents you from autopiloting into bad habits and ensures that your financial plan is a living document that adapts to the changing conditions of your life.

You have the mind of a strategist. You’ve honed your ability to see complex systems, manage scarce resources, and execute long-term plans to achieve a decisive victory. Personal finance isn’t a different skill set; it’s the same skill set applied to a different game.

Stop treating your money like a tutorial level you can just click through. See it for what it is: the ultimate 4X game of exploration, expansion, exploitation, and extermination (of debt). Scout your terrain, define your victory condition, execute your build order, and relentlessly optimize your GPM. The game is on, and you have every tool you need to win. Now, go and claim your victory.